how to decide on term life insurance

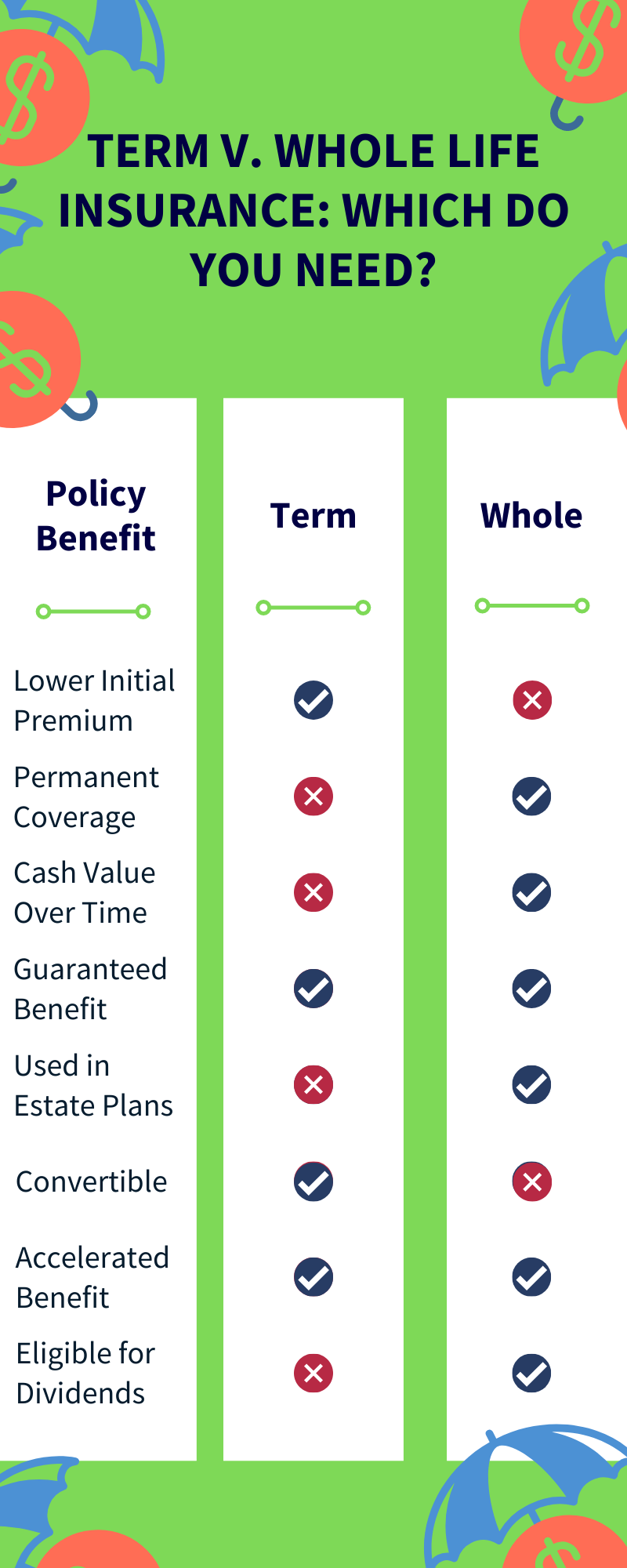

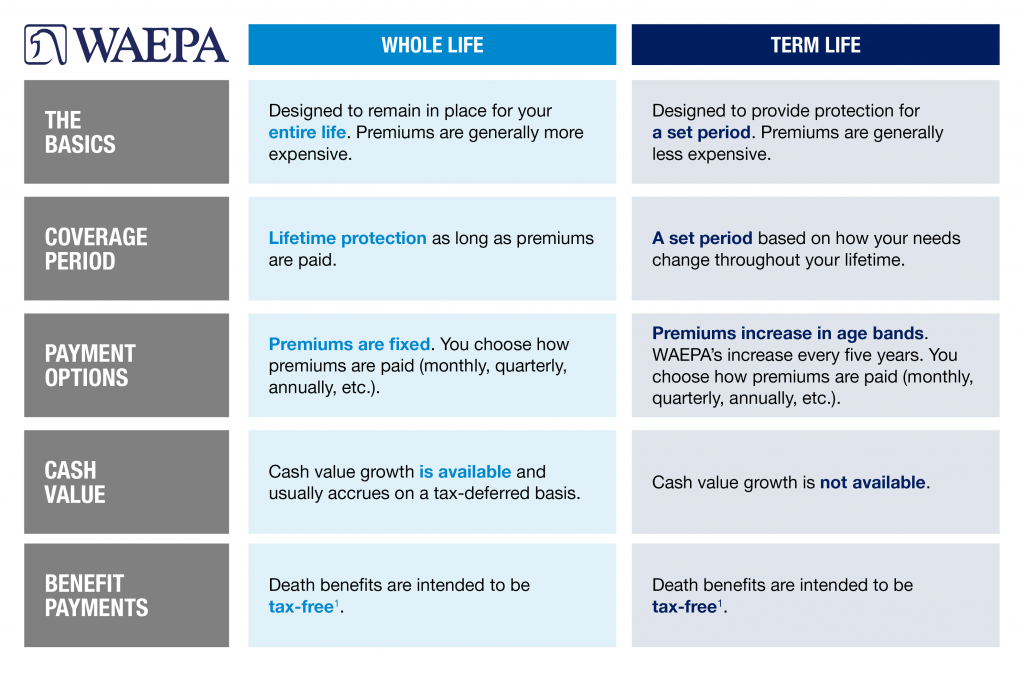

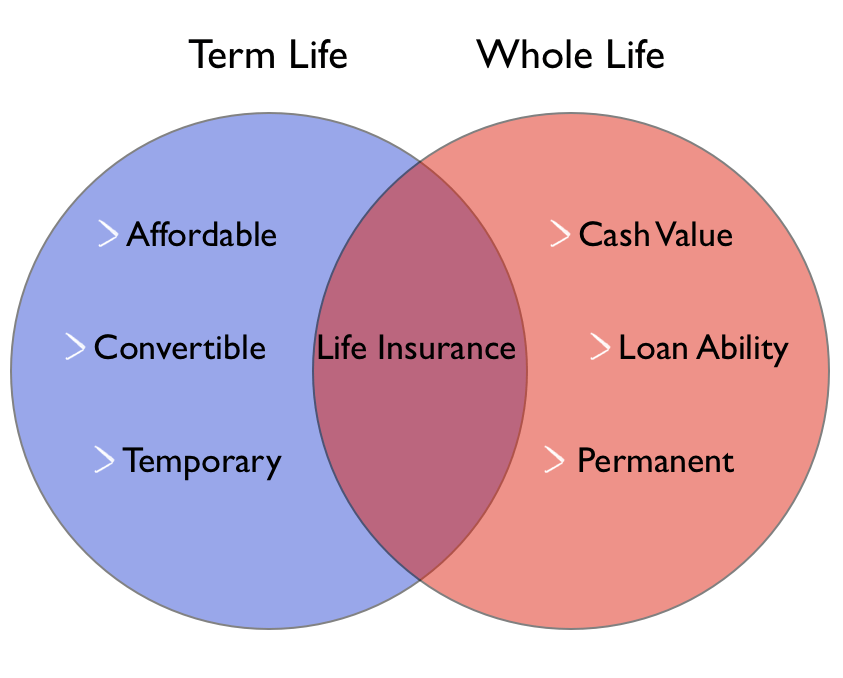

Once the need for life insurance is determined the discussion almost invariably turns to the choice of term life insurance versus whole life or permanent insurance. If you know a term-to-perm conversion is something.

Term insurance plans were introduced with a very basic.

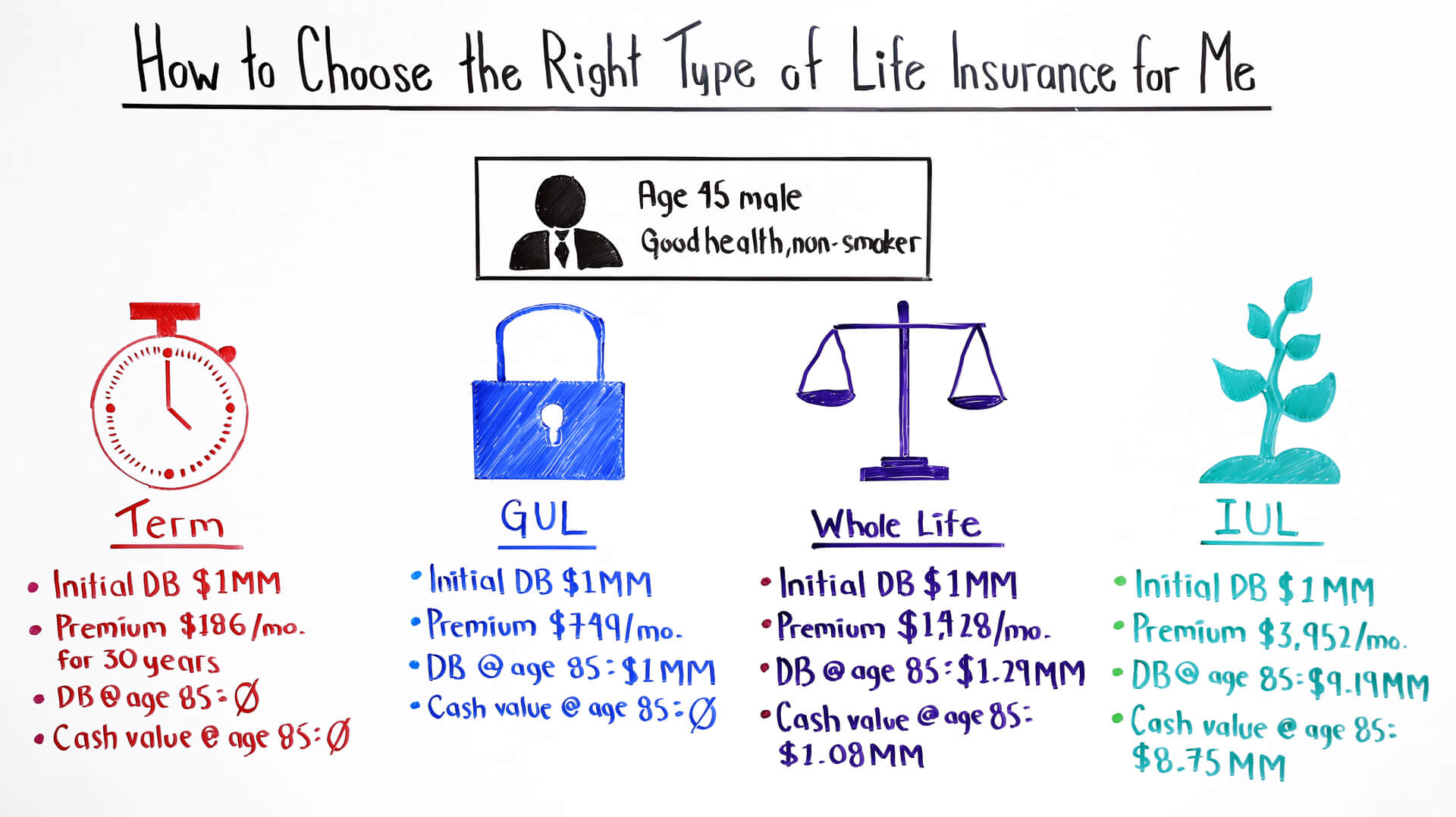

. Your overall life insurance cost will depend on health gender age and lifestyle choices. On average here is what you can expect to pay per month. How to get good life insurance rates today.

Both term and whole life insurance provide. This disparity is because with term life insurance the. Your actual premium will be determined by underwriting review.

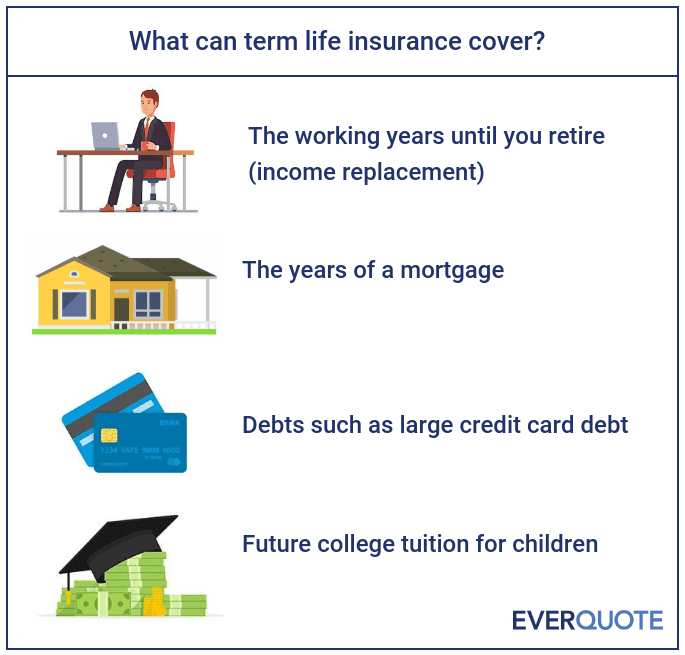

In this case you might choose to buy a separate term life insurance policy to provide more coverage and be able to meet your financial goals in the short term. Term life insurance is usually more economical than whole life insurance. This allows you to choose the best term for your needs without.

Quotes reflected are an example from Policy Genius. Honestly assess what you want - and need. Convert from term to perm life insurance by following these four steps.

1 day agoBenefits of term life insurance. Learn how to decide between term and whole life insurance. How to choose a term length.

The average cost for a 10-year term life insurance policy is 180 a year for 500000 in coverage for a 30-year-old female based on Forbes Advisors analysis of life. Take for instance the premium rates of iProtect Smart term cover from. PolicyMe offers term lengths of 10 15 20 25 and 30 years which is standard for the life insurance industry.

Take a hard look at what you. Claim Settlement ratio of a company. Like much else about life insurance there is no one-size-fits-all choice for term length.

Here are five steps that can help you get the best deal. Find your conversion deadline. Claim settlement Ratio of Insurance Companies.

Based on the tenure the insurance company keeps on increasing your term insurance premium. Consider how long a term life policy will be required. While choosing a term insurance plan one of the major points to consider is Claim settlement ratio.

This blog on how to choose best term insurance plan would definitely help you pick your perfect term plan. Acquiring life insurance is an excellent way to prepare for your familys future financial needs. Heres what you need to know about life insurance options and how to choose the right policy for you.

Term Vs Whole Life Insurance How To Know Which One You Need Gobankingrates

Term Life Insurance Insider Tips Research Rates Insuranceproviders Com

How To Decide Term Vs Permanent Life Insurance American Family Insurance Youtube

How Term Life Insurance Can Help You 1891 Financial Life

:max_bytes(150000):strip_icc()/dotdash-term-life-vs-whole-life-5075430-Final-60fb4e8f7bae43e0a65a3fac2431479c.jpg)

Term Vs Whole Life Insurance What S The Difference

Term Life Or Whole Life Insurance Which One Should I Choose

Episode 106 How To Choose The Right Type Of Life Insurance For

How To Buy Life Insurance In October 2022 Policygenius

Life Insurance Coverage For You And Your Family Everquote

Direct Term Life Insurance What Is It 2022

Free Term Life Vs Whole Life Insurance Calculator Insurance Geek

The Difference Between Term Whole Life Insurance Waepa

Breaking Down Term Life Insurance

How To Lower Your Life Insurance Premium

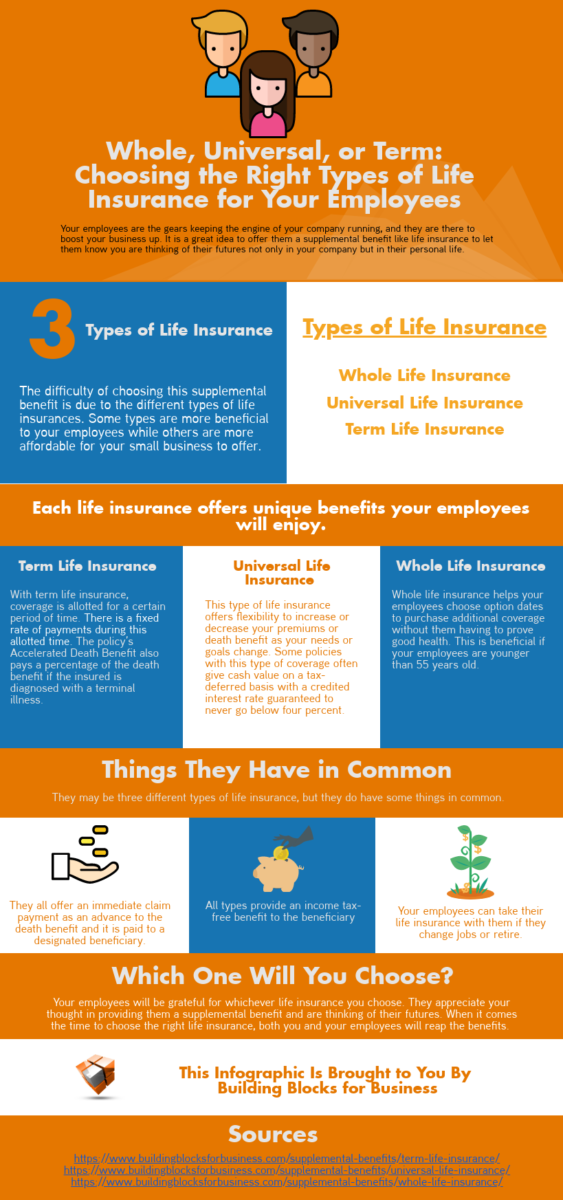

Whole Universal Or Term Choosing The Right Types Of Life Insurance For Your Employees Infographic Building Blocks

:max_bytes(150000):strip_icc()/dotdash-ask-answers-205-Final-7a1ca51b85d44e0d81dc7b46f919180d.jpg)

Term Vs Universal Life Insurance What S The Difference

Term Life Insurance Is A Low Cost Way To Protect Your Family Better Mortgage

Term Life Vs Whole Life Insurance Understanding The Difference

Personal Life Insurance Explained Https Www Insurechance Com